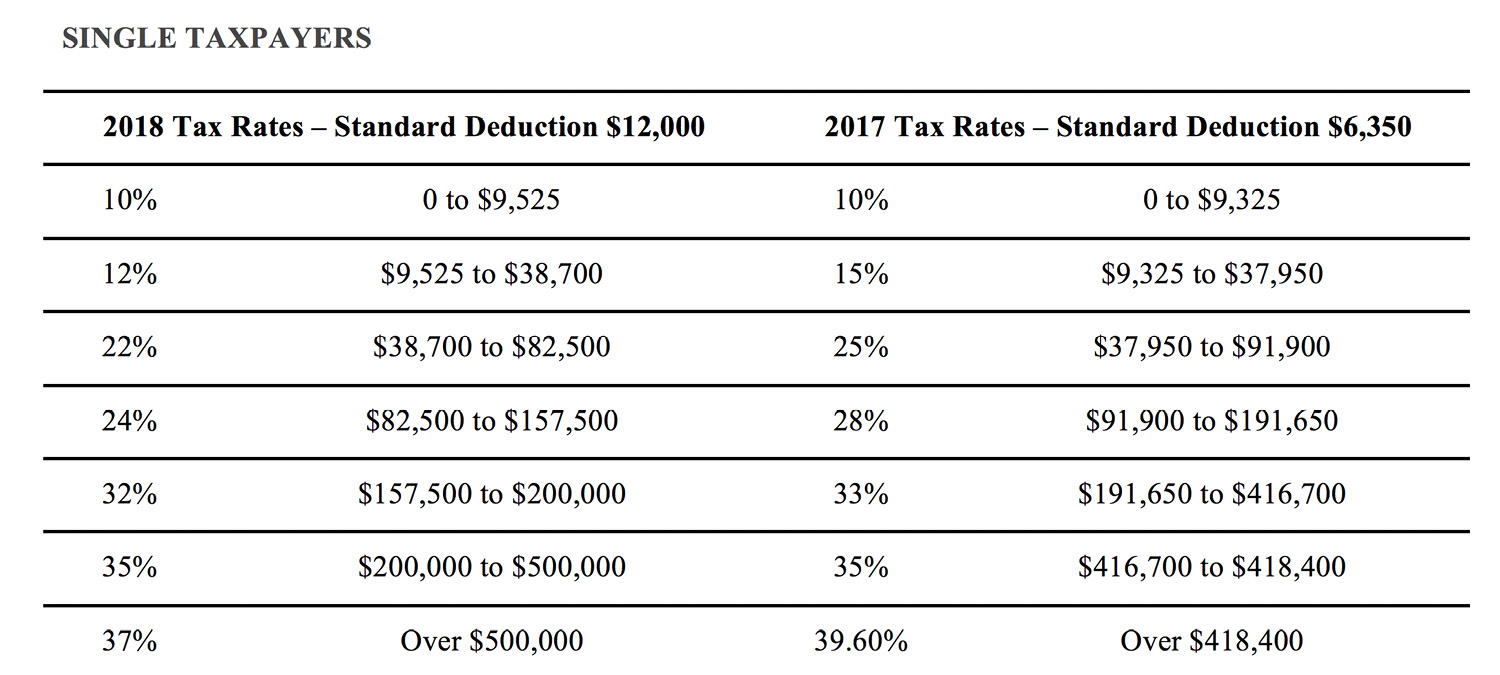

2017 v. 2018 Federal Income Tax Brackets For the tax year beginning January 1, 2018, tax brackets and rates will be changing. Seven (7) tax rates will remain: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Standard deduction amounts will increase to $12,000 for individuals, $18,000 for heads of household, and $24,000 for married couples filing jointly and surviving spouses. The additional standard deduction for the aged or the blind is $1,300 and unmarried taxpayers additional standard deduction will increase to $1,600.

Since there will be no personal exemption amounts for 2018, individual and married taxpayers will need to review the new rates and standard deductions to determine if they are required to file a tax return.

Additional tax credits and deductions adjusted for 2018 include:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Adoption Credit

- Student Loan Interest Deduction

- Foreign Earned Income Exclusion

- Medical Savings Accounts (MSA)

Significant Changes to itemized deductions include:

- Medical and Dental Expenses

- State and Local Taxes

- Home Mortgage Interest

- Charitable Donations

- Casualty and Theft Losses

- Job Expenses and Miscellaneous Deductions subject to 2% floor

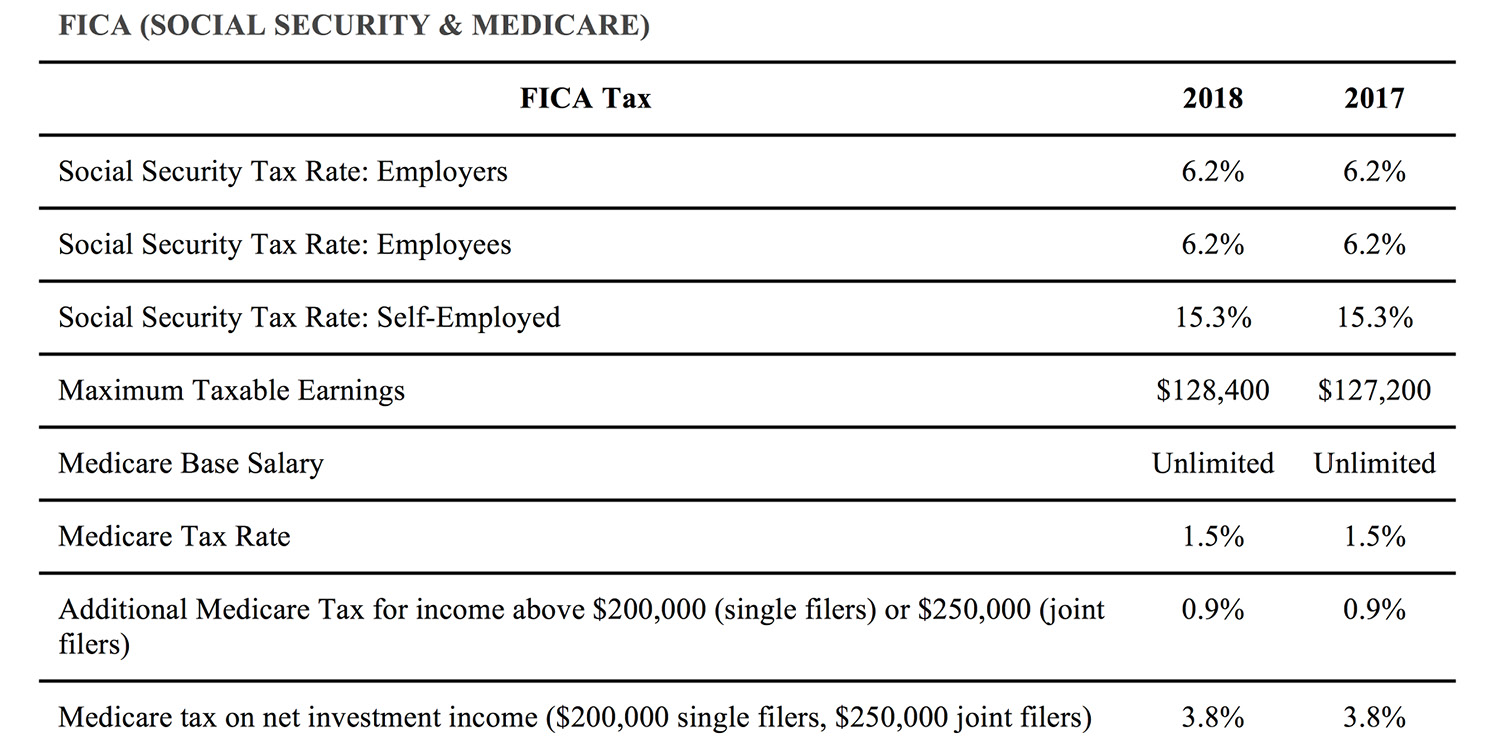

Below are the bracket comparisons of tax rates from 2017 and 2018. If you have any questions on how you will be affected by the revised tax rates, contact Doshi and Associates for a consultation! 248.858.8580